New York’s NY-Sun Program allows homeowners, renters, and businesses to leverage incentives and funding opportunities that help make renewable energy more affordable. Implementing solar power has numerous advantages, and with the help of incentives and credits, it can be far more cost-effective than many business owners think.

This guide explores the NY-Sun Program, its importance, and program funding opportunities. It also explores the top incentives for businesses to apply and how to apply.

What Is the NY-Sun Program?

The New York Solar Program, also called the NY-Sun Program or NY-Sun Incentive, is a state-wide initiative that provides incentives, financing, and a network of qualified installers to make solar-generated electricity more affordable and accessible to New York businesses, homeowners, and renters.

Its aim is to encourage more people to use solar electricity to lower energy costs throughout the state and improve the reliability and efficiency of the electric grid. Generally, businesses must have an electric utility account and participate in a utility payment assistance program to qualify. Multifamily building owners and managers of affordable housing properties may also qualify.

There are two types of solar energy:

- Community solar: This type of solar energy permits New York state businesses, renters, and homeowners to use solar power generated within the state without installing panels.

- On-site solar: Municipalities, businesses, multifamily buildings, and homes may generate their own renewable energy by installing ground-mounted or rooftop solar equipment on their property.

The Climate Act set a goal to install 6 gigawatts (GW) of distributed solar energy by 2025. Since New York already achieved this goal in the fall of 2024, the state now has a new goal of targeting 10 GW of solar energy by 2030.

Why Solar Energy Is Important in New York

Solar energy can help New York reduce high electricity costs and its impact on climate change. Here are some of the statewide factors and benefits that make going solar worth it:

- Lowers energy bills: Businesses typically won’t need to pay for the electricity stored in the power grid. They will only pay for electricity if they use more than the solar panel system can generate.

- Reduces air pollutants: Solar energy has a smaller impact on climate change and reduces the presence of air pollutants, minimizing the emission of greenhouse gases and carbon dioxide.

- Improves reliability: If power outages occur, businesses can rest assured that employees can stay productive due to the solar energy available.

NY-Sun Program Funding Opportunities and Allocation Levels

The New York State Energy Research and Development Authority (NYSERDA) offers various funding opportunities divided into competitive solicitations and unsolicited proposals. Competitive solicitations include four main types:

- Program Opportunity Notice (PON): This includes ensuring a project meets technical, environmental, and economic goals and objectives within a specific program area. It also allows for cost-sharing and multiple awards.

- Open Enrollment PON: An organization may opt for this solicitation to receive numerous awards, subscription incentive-based program offers, and cost-sharing opportunities.

- Request for Proposals (RFP): This can be valuable when an organization with a particular area of interest fills out a highly specific Statement of Work to describe its goal in detail. This may incur a single reward or multiple rewards and may not include cost sharing.

- Requests for Quotation or Qualifications (RFQ): This option is beneficial for securing contracts based on contractor qualifications or cost. While an RFQ doesn’t typically include cost sharing, it may result in single or multiple rewards.

While NYSERDA generally prefers to offer funding opportunities on a competitive basis, it allows unsolicited proposals for funding, depending on the proposal. Unsolicited proposals usually focus on a particular research topic, whereas competitive solicitations are issued to bring attention to multiple approaches.

When NYSERDA recognizes and considers an unsolicited proposal related to an upcoming competitive solicitation, it asks the proposer to resubmit it according to the competitive solicitation’s guidelines. Accepted plans are typically considered excellent work that aligns with the NY-Sun multi-year program plan. They should also be cost-effective and technically sound.

Current Funding Opportunities

Some current funding opportunities in the competitive solicitations landscape include the Affordable Solar and Storage Predevelopment and Technical Assistance PON, the Early Design Support RFP, the Clean Energy Training Services RFQ, and the Appliance Upgrade Program PON.

Under the Megawatt Block Solar Incentive, the NY-Sun Program funding opportunities and financial incentives are divided into regions across the state. Each block within a region is assigned a certain number of incentives for businesses to leverage before its closing date. This makes it important for companies to act fast and apply before the relevant deadline. Currently, only two regions have remaining NY solar power incentives to assist companies in installing solar energy at an affordable rate.

The Con Edison residential region still offers funding in Block 9. This grant allows businesses to receive an incentive of $0.20 per watt. While Block 9’s size is 270,000 kilowatts (kW), just over 256,000 kW have already been used by interested companies, making it critical to apply as soon as possible.

Similarly, Block 2 of the Con Edison nonresidential region offers an incentive of $0.80 per watt and has around 4,015 kW remaining out of its original 30,000 kW. Still, two more Con Edison nonresidential region incentives, $0.50 per watt and $0.80 per watt, have barely been used halfway. Another block with 30,000 kW is yet to be opened.

The Upstate region also offers solar incentives, with three blocks still open. Block 12 of the Upstate residential region has over 15,000 kW remaining at $0.20 per watt. The Upstate nonresidential region’s Block 10 still offers around 69,000 kW at $0.25 per watt. Lastly, the Upstate commercial region’s Block 21 has around 173,000 kW remaining at $0.05 per watt.

For the most accurate and updated information about the availability of incentives and the status of specific blocks, businesses should check the NYSERDA website or contact them directly to learn more.

How to Apply for the NY-Sun Program

To apply for the NY-Sun Program with on-site solar energy, businesses will need to find a contractor and explore projects. Working with a contractor who participates in the NY-Sun program can help the company understand its eligibility more thoroughly. This includes eligibility for additional predevelopment assistance, technical assistance, and affordable multifamily housing.

To apply for the community solar part of the NY-Sun Program, companies should identify a local community solar project and research its subscription plans and rates. It’s beneficial for businesses to choose a plan that aligns with their business plans and needs. Organizations will then receive credits on their electric bills for the energy the community solar project produces.

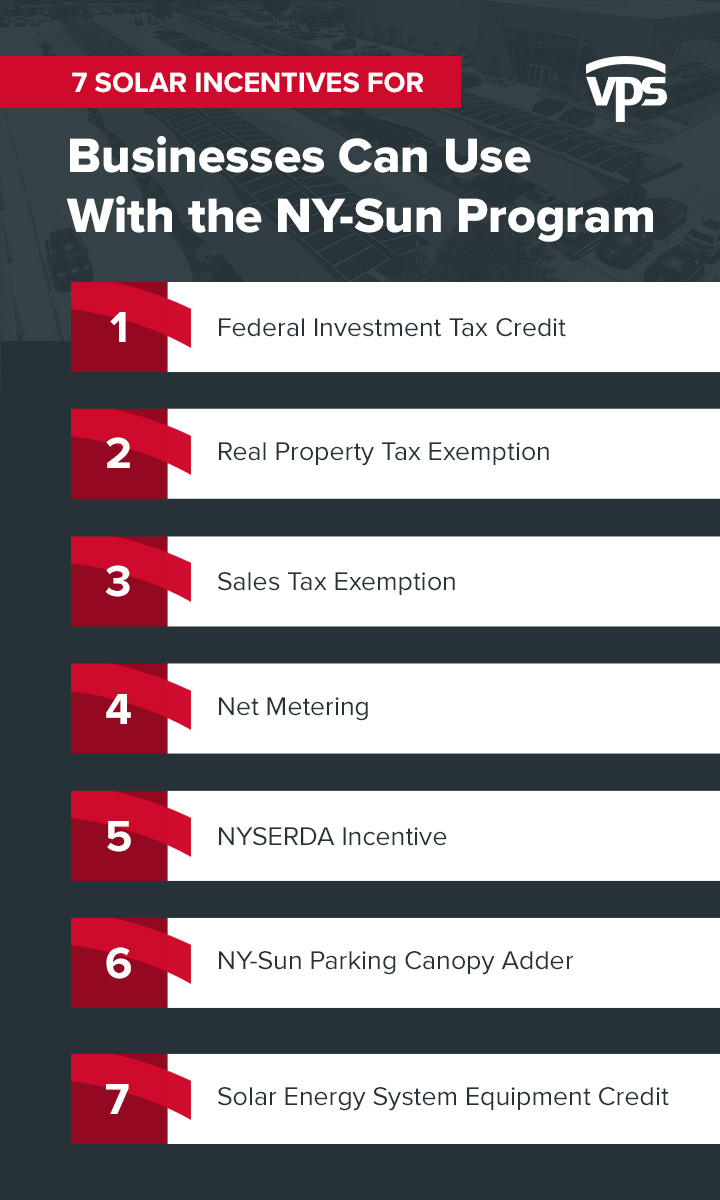

7 Solar Incentives for Businesses Can Use With the NY-Sun Program

The NY-Sun Program offers three levels of incentives across project categories, including large commercial/industrial, residential, and nonresidential. These incentives help make it easier to adopt solar energy use in diverse sectors.

Here are some of the top incentive options for businesses in New York:

1. Federal Investment Tax Credit

The Investment Tax Credit (ITC) lets companies deduct a percentage of the cost of installing solar from their federal taxes. The ITC is currently set at 30% for solar systems beginning construction by 2032. This tax credit is available for solar photovoltaic (PV) systems and solar water heating systems installed at a business location and used for business purposes.

2. Real Property Tax Exemption

Because solar panels can boost a property’s value, they can also increase property taxes. Depending on the company’s location within New York, it may be able to benefit from a property tax exemption. This can allow businesses to deduct a percentage of the total cost of the eligible solar system from their property taxes and may be valid for up to 15 consecutive years.

3. Sales Tax Exemption

New York also provides a sales tax exemption for the sale of solar panels. This exemption allows businesses to earn more from their sales — businesses engaged in selling solar panels aren’t required to collect sales tax on those transactions. This sales tax exemption can also benefit companies by reducing the overall cost of purchasing solar panels and making them more affordable for customers.

4. Net Metering

Net metering or net billing allows businesses to earn credits on their bills for excess electricity they’ve generated but haven’t used. They may either store this energy in a battery or let it flow to the grid. Businesses may take advantage of one-to-one net metering — for each kilowatt-hour of electricity the solar panel sends to the grid, the owner receives a credit to offset electricity consumed from the grid.

5. NYSERDA Incentive

New York offers a NY-Sun Program incentive to directly assist contractors in minimizing costs. This is usually paid out by block of the program and region. According to NYSERDA, if a company’s solar project takes place in the Upstate or Con Edison regions, solar costs may be reduced by $0.20-$0.80 per watt.

6. NY-Sun Parking Canopy Adder

For companies in Con Edison installing solar canopies on their parking spaces, the NY-Sun Program offers an additional $0.20 per watt incentive. The incentive is also based on blocks and is currently in Block 6 to Block 10. This grant allows businesses to earn further revenue while providing customers and employees with electric vehicle charging stations, shaded parking, and LED lighting.

7. Solar Energy System Equipment Credit

New York State offers a credit specifically for those purchasing or leasing solar power system equipment. The solar energy system must be used for generating heating, cooling, hot water, or electricity on the property. The credit is 25% of the qualified solar energy system equipment expenditures up to $5,000 and is nonrefundable.

How NY-Sun Incentives Work

The NY-Sun Program applies to both financed and purchased solar systems. When businesses have less tax liability than their credit amount, they can carry forward unused credit to future years. Avoiding leases can help companies save up to $40,000 and $80,000 compared to staying on the grid.

To get a full picture of how the NY-Sun Program incentives work, let’s say a business spends $25,000 on a solar installation. Depending on its eligibility, it may receive a $7,500 (30%) federal ITC and a $5,000 state tax credit, reducing the cost by 50%. Depending on other incentives the business qualifies for, it may reduce its tax responsibilities further.

Options for Businesses Using the NY-Sun Program

Here are four ways businesses can use the NY-Sun Program:

- Low interest rate loans: The NY-Sun Program provides business owners with three different types of loans — participation loans, on-bill recovery loans, and property-assessed clean energy (PACE) loans. While participation and on-bill loans are capped, PACE loans may cover up to 100% of the cost of the project, depending on the company’s eligibility.

- Refunds on utility bills: This option aligns with the net metering incentive that considers unused electricity added to the grid. It only pertains to unused credits for a future rebatement.

- Rebates and tax credits: When purchasing solar equipment, business owners may be covered under the Solar Energy System Equipment Credit and the Megawatt Block Solar Incentive. Combining the two may allow them to save thousands on equipment expenditures.

- Power-purchasing agreements (PPAs): Business owners may avoid upfront costs and maintenance responsibilities with a power-purchasing agreement. This agreement requires that one buys and uses energy generated by a solar electric system installed and owned on their property by a solar financing company.

Make the Most of NY Solar Incentives With VPS

If your business is located in New York State and plans to go solar, many incentives and credits are available to help make the transition smoother and more affordable. In particular, many businesses can greatly benefit from installing solar shade structures. These solutions offer invaluable vehicle protection, all while potentially benefitting from incentives like the NY-Sun Parking Canopy Adder.

VPS delivers custom-tailored shade structures optimized to protect vehicles from harmful UV rays and hail. We design durable solar car covers to protect vehicles and help businesses save on energy bills. Additionally, companies can benefit from tax advantages, cooler site temperatures, and reduced risk of operational disruptions.

Whether you own an auto dealership or want to set up covered rooftop parking at your parking garage, VPS can help you enjoy the benefits of shaded coverage and the power of solar. To learn more, contact our professionals at VPS today.